Geneva Was the Fog. This Is the Fracture.

MSIQ Radar Drop – May 31, 2025 | Free Tier (Strategic Pivot Edition)

"So much for being Mr. NICE GUY!" — Donald Trump, Truth Social, 8:03 AM ET

The quote hit just after market open. The truce is over.

Or more precisely: the truce never existed.

What Geneva delivered was not peace. It was delay. A regulatory pause dressed as resolution.

And now, 19 days later, the choreography breaks. Not with tanks or tariffs — but with licensing, export approvals, and suppressed flows.

What Just Happened

Trump accused China of “totally violating” the Geneva deal.

**USTR Jamison Greer confirmed: "China is slow-rolling compliance."

China fired back: rare earth approvals have not resumed; the U.S. must end its semiconductor sanctions.

Markets twitched, then shrugged: the S&P 500 closed flat on Friday, but intraday fell as much as 1.1%.

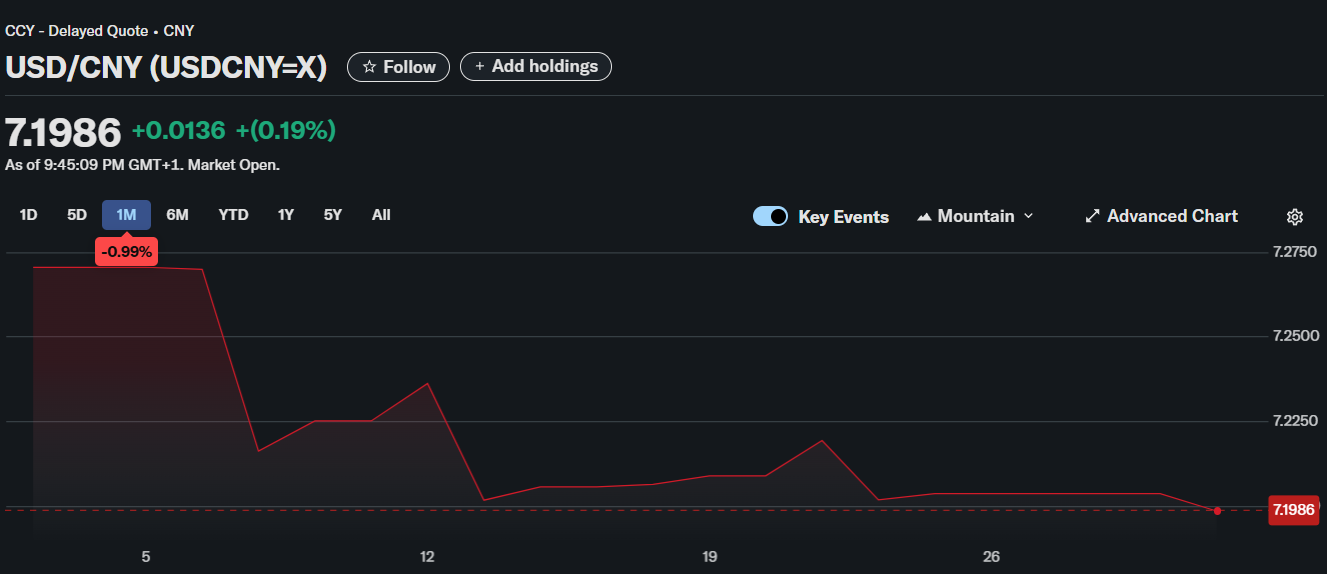

Beneath the surface: FX drift (USD/CNY -0.99% in May), volatility suppression, and the slow unspooling of reciprocal retaliation.

The Real Deal Was Rare Earths

Multiple officials confirmed what MSIQ flagged weeks ago:

The Geneva handshake only happened after China agreed to resume rare earth exports.

But China never followed through. Licenses weren’t issued. PLA-linked logistics firms slowed cross-border processing. And U.S. automakers began warning of pandemic-style plant stoppages.

Why?

Because the U.S. never lifted pressure on Huawei AI chips. GP10 export bans, license denials, and whispered enforcement threats never stopped.

Geneva was a shell.

A theater of mutual hesitation.

Until the narrative broke.

This Is Phase 3: Legalized Compression Warfare

This is not a return to trade war. This is the birth of something new:

A modular, delay-based economic confrontation where both sides use law, logistics, and FX to break alignment — without headlines.

Trump uses Section 301 (Trade Act of 1974) as a backup lever, bypassing court rulings that blocked emergency tariffs.

China uses export license audits, student visa bans, and semiconductors as pressure valves.

Currency drift becomes signaling: the yuan quietly weakens to 7.1986, amplifying exports, but keeps volatility capped.

Markets Are Mistaking Delay for Resilience

Wall Street cheered the S&P 500’s 6% gain in May.

But under that surface:

Vanguard S&P 500 ETF (VOO) saw $10B in inflows.

Volatility ETFs plunged ~25%.

Defensive sectors underperformed cyclicals by 10 points.

Goldman’s Stagflation Basket posted its worst month in 20 years.

This wasn’t buy-and-hold wisdom. It was institutional paralysis meeting unpriced policy compression.

What MSIQ Saw Before the Crowd

May 12: We flagged timestamp divergence — China throttled minerals before Geneva.

Vault 046: GP10 as soft retaliation framework.

Node 9: Trade as Theater, Power as Architecture.

Ghost Node 003: Digital Dominion + Export Control Weaponization.

MSIQ is not a macro blog. It is a radar for capital asymmetry.

We don’t mirror headlines. We monitor the fault lines they avoid.

The Dollar, the Courts, and What’s Next

Trump’s next phase is already coded:

Tariff escalation via Section 301

Currency drift as compression relief

Legal fog as strategic delay (CIT vs Supreme Court battles)

China’s response?

Rare earth throttling will expand to gallium and tungsten

Semiconductor framing war will intensify via diplomatic PR (see Chinese Embassy statement to NBC)

AI + EV supply chains become leverage nodes, not economic policy

This Is Where MSIQ Comes In

The noise will only grow louder.

More tweets. More FX churn. More Substack floods.

But the trade war is no longer about tariffs.

It’s about who controls the delay. Who builds the better legal maze.

And who spots the fracture before the rerating begins.

That’s what MSIQ is built for.

To show you compression that hasn’t priced.

To diagram flows others won’t even name.

To turn fog into direction.

This drop is public. What comes next is filtered.

Despite trade flareups, the yuan didn’t blink. USD/CNY fell ~1% in May — a signal that Beijing prefers surgical levers, not blunt retaliation. Source: Yahoo Finance.

To access MSIQ’s Vault Briefs, Structural Nodes, and Sovereign Drop Reports — upgrade below or contact us directly.

MSIQ — Midstream Intelligence

Trade the Compression. Before It Trades You.