MSIQ ALERT: Suspension Without Reconnection – Why Export Control Pause Has Not Restored Supply

Markets are reacting to a regulatory suspension. They are not pricing physical restoration.

As of today, the aggressive extraterritorial export-control measures originally scheduled to fully activate on December 1 have been formally deferred. MOFCOM Announcement No. 70 (issued Nov 7) suspends the entire October 9 Package (Announcements 55–58, 61, 62) through November 10, 2026.

On paper, three major legal constraints have been paused:

Extraterritoriality Deferred: The “0.1% de minimis“ rule and PRC “50% Affiliates Rule”—which would have extended Chinese controls to foreign-made products—are not being implemented.

US Ban Technically Suspended: A separate directive temporarily lifts the December 2024 “in-principle ban” on gallium, germanium, and antimony exports to the U.S. until late 2026. Licenses remain mandatory; military end-use restrictions still apply.

But the physical flow data tells a different story.

Customs volumes have not normalized. In some cases, they have deteriorated further. This is suspension without reconnection—legal relief did not translate into restored throughput.

MSIQ TRACK RECORD

This analysis validates our November 7 assessment, which predicted: “China will grant tactical relief while retaining structural control.”

Outcome (as of Dec 1): Exact match - 1-year suspension with licensing architecture intact and physical flows still constrained.

Previous validated predictions:

- Trump-Xi Busan Framework (Oct 2025): Called “tactical relief, structural control” 5 days before summit

- PFAS Coolant Chokepoint (Q1 2025): Identified AI data center vulnerability 6 months before DoD confirmed as national security risk

MSIQ identifies 60–90 day lead signals of upcoming disruptions in critical materials flow by combining forward-looking regulatory monitoring with 16 years of operational and transaction experience across Asian resource corridors.

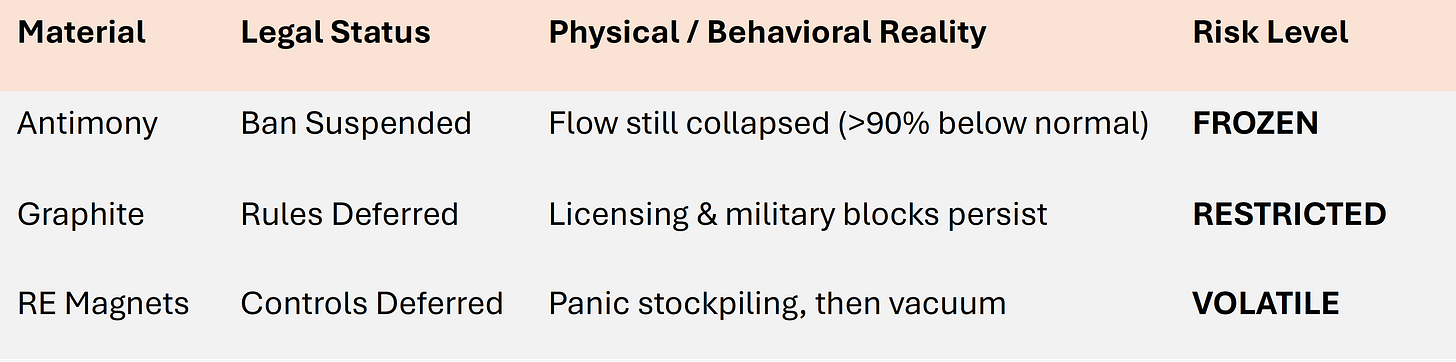

1. ANTIMONY: Legal Ban Suspended. Flow Still Collapsed.

October Export Volume: 180 tons of antimony oxide (global total).

Historical Baseline: 3,000–4,000 tons per month.

Delta: Exports remain down >90%.

The pipeline did not restart. The suspension removed the ban, but did not restore supply behavior. Flame retardants, specialty alloys, and military propellant supply chains remain structurally impaired. This is not a slowdown—this is a disconnection.

MSIQ Assessment: FROZEN (High Risk). Risk is behavioral, not legal.

2. GRAPHITE: The Constraint Has Shifted (Law → Capacity)

While Announcement 70 suspended the new Oct 9 controls on synthetic anode materials (Announcement 58), three choke factors remain fully active:

Licensing Regime: Exports still require strict licensing under previous dual-use frameworks.

Military Prohibition: End-use blocks remain in place, unaffected by the suspension.

Equipment Bottleneck: Graphitization furnace exports remain constrained, limiting ex-China anode scale-up.

Result: Legal tightening has been deferred, but capacity risk remains live. Ex-China anode build-out remains structurally constrained.

MSIQ Assessment: RESTRICTED. Active risk via licensing & processing.

3. RARE EARTH MAGNETS: Inventory Front-Loading, Not Supply Relief

Ahead of the expected Dec 1 enforcement date, U.S. defense and industrial buyers accelerated stockpiling.

U.S. Imports (Oct): 656 tons (+56.1% m/m)

China Total Exports (Oct): 5,473 tons (-5.2% m/m)

This is not evidence of resumed supply. It is evidence of pre-deadline positioning, likely to be followed by a Q1 2026 order vacuum and price volatility.

MSIQ Assessment: VOLATILE. Behavioral whiplash expected.

MSIQ POSITIONING SUMMARY

Core View: Controls were paused. Behavior did not normalize. Legal relief removed the headline risk, but it did not restore supply-chain security.

WHAT THIS MEANS FOR YOUR SUPPLY CHAIN

DEFENSE CONTRACTORS

Antimony shortage directly affects:

- Flame retardants in wiring harnesses and electronics enclosures

- Lead-acid battery grids for backup power systems

- Military propellant chemistry and tracer ammunition

Action: Secure 12-month inventory at current pricing before Q1 2026

shortage premium hits. Alternative suppliers (Bolivia, Tajikistan) remain

capacity-constrained.

EV BATTERY & ELECTRONICS MANUFACTURERS

Graphite processing bottleneck remains active despite legal suspension:

- Equipment export restrictions still in place (graphitization furnaces)

- Ex-China anode scale-up structurally constrained

- Licensing regime and military end-use blocks unchanged

Action: Accelerate qualification programs for non-Chinese anode suppliers.

Current lead times: 18-24 months for new supplier certification.

INDUSTRIAL BUYERS (MAGNETS, MOTORS, GENERATORS)

Rare earth magnet price volatility incoming:

- October’s +56% U.S. import surge was stockpiling, not supply restoration

- Expect demand vacuum and price whipsaw in Q1 2026

- China total exports actually declined 5.2% month-over-month

Action: Hedge forward positions or lock Q1-Q2 2026 contracts now at

current prices before post-stockpile volatility hits.

NEED MATERIAL-SPECIFIC ANALYSIS?

MSIQ provides daily intelligence on Chinese critical materials restrictions with 60-90 day advance warning before market consensus forms.

For supply chain exposure analysis or material-specific briefings:

Email: info@midstreamiq.com

Direct: +852 4449 6555

Subscribe for daily alerts: