WHITE PAPER: The Ganqimaodu Divergence

Quantifying the “Implementation Gap” in Rare Earth Supply Chains

Date: December 11, 2025

Author: MSIQ Intelligence Desk

1. Executive Summary

Global markets currently price Rare Earth Elements (REE) based on published quotas and policy headlines. This is a fundamental pricing error.

In the highly concentrated NdFeB (Neodymium-Iron-Boron) magnet supply chain, Policy Does Not Equal Availability.

MSIQ has identified a structural “Implementation Gap” between Beijing’s export narratives and the physical reality at the primary chokepoint: the Ganqimaodu-Baotou Logistics Corridor.

Our proprietary data indicates that while official quotas remain stable, physical feedstock throughput has degraded significantly in Q4 2025. This divergence is a 20-day leading indicator for spot price volatility in the PrNd oxide market.

2. The Mechanism: Why Coal Predicts Magnets

To understand the signal, one must understand the unique metallurgy of the Bayan Obo Complex (which produces ~70% of China’s light rare earths).

Unlike Western deposits, Bayan Obo rare earths are a by-product of iron ore mining. However, the blast furnaces at Baotou Steel require a specific blend of high-grade coking coal to process this ore efficiently.

The Constraint: This specific coking coal is imported almost exclusively from Mongolia via the Ganqimaodu Border Crossing.

The Logic Chain:

Truck Flow Drops: Coking coal inventory at the border creates a backlog.

Furnace Throttling: Baotou Steel adjusts intake to conserve fuel.

Slag Reduction: Less iron ore processed = Less Rare Earth Slag produced.

Supply Shock: 20 days later, refined oxide availability tightens in the spot market.

Most analysts track the Oxide price. We track the Coal Trucks.

3. The Current Signal (December 2025)

Status: RED LIGHT

As of December 8, 2025, our “North Asian Logistics Monitor” highlights a critical divergence:

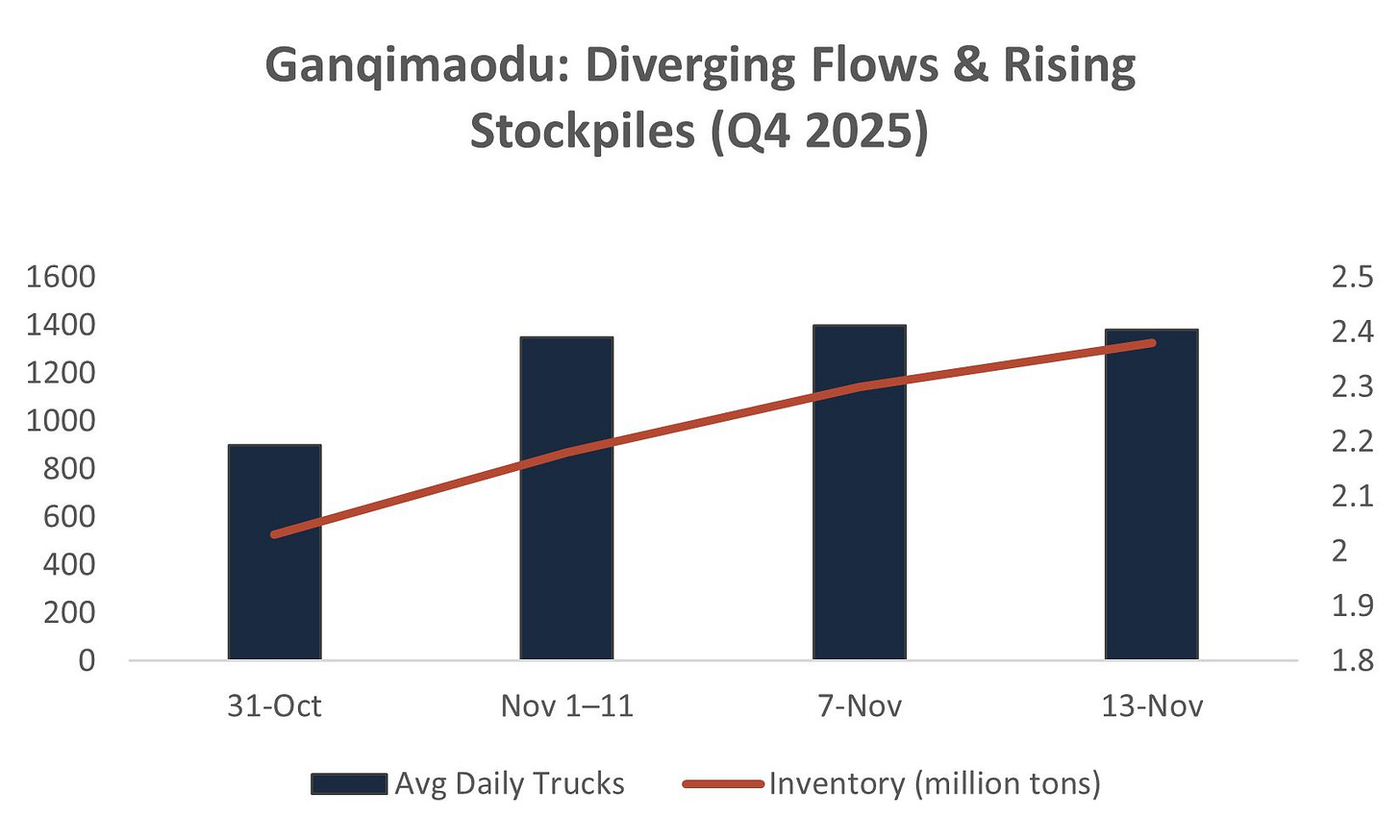

Inventory Build: Coal stockpiles at the Ganqimaodu storage yards have breached 2.35 million tons (the red line on the chart).

Throughput Velocity: despite high inventory, daily truck clearances to Baotou have slowed (the blue bars).

The Implication: The logistics chain is “constipated.” The coal is sitting at the border, not entering the furnaces.

Assessment:

This suggests an unannounced administrative throttling of Baotou Steel’s production rates, likely tied to the “Dual Control” energy consumption mandates re-emphasized by Beijing in September.

While the market sees “normal” export quotas, the physical machinery producing the rare earths is operating at reduced capacity.

4. Market Impact & Strategic Outlook

The “Implementation Gap” creates an asymmetric risk profile for Q1 2026.

Demand Side:

Western capital is flooding into the sector (e.g., the recent Orion Consortium mandate), assuming supply continuity.

Supply Side:

The Ganqimaodu signal suggests a supply air-pocket is forming. When the current spot inventory clears, the market will realize the replacement barrels from Baotou are not there.

Conclusion:

For allocators with exposure to the Rare Earth (MP, LYC), Fluorochemical (CC, ORBIA), or Grid Steel (CLF) complexes, the physical indicators suggest a tightening environment that is not yet priced into the forward curve.

MSIQ tracks this corridor weekly, alongside Fluorine (Semi/Battery precursors) and Electrical Steel (GOES) vectors.

Subscribe to the Weekly “Red Light Report” for live updates on these signals.

Disclaimer: The content of this report is for informational purposes only and does not constitute financial advice or an offer to sell any securities. MSIQ and its affiliates may hold positions in financial instruments mentioned in this report and may trade them for their own account. All data is based on best-effort analysis of public information.